tax strategies for high income earners canada

A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century. Texas does not tax personal income or capital gains.

Seven Year End Tax Tips For Canadians Sun Life Global Investments

The United States is a highly developed mixed-market economy and has the worlds largest nominal GDP and net wealthIt has the second-largest by purchasing power parity PPP behind China.

. That number if multiplied by 8-hour brings the average household daily wage to 29020 or 1451 average household weekly wage. The Internal Revenue Service IRS adjusts tax brackets for inflation each year and because inflation is so high its possible you could fall to a lower bracket for the income you earn in 2023. Stock is up 10 - Netflix beat third-quarter expectations on the top and bottom lines Tuesday The company said it.

Universal basic income UBI is a sociopolitical financial transfer policy proposal in which all citizens of a given population regularly receive a legally stipulated and equally set financial grant paid by the government without a means test. One proposal for universal healthcare recently pushed included options such as a 75 payroll tax plus a 4 income tax on all Americans with higher-income citizens subjected to higher taxes. US share of Global economy is 1578 in PPP terms in 2022.

The Utah state income and capital gains tax is a flat rate of 485. Urban High School Student. This may include tax avoidance which is tax reduction by legal means and tax evasion which is the criminal non-payment of tax liabilities.

If the level is sufficient to meet a persons basic needs ie at or above the. The median multiple indicator recommended by the World Bank and the United Nations rates affordability of housing by dividing the median house price by gross before tax annual median household income. We will ensure we give you a high quality content that will give you a good grade.

Its most general use describes non. Traditional IRA Income Limits Find out if you can contribute and if you make too much money for a tax deduction in 2021 and 2022. If this is also happening to you you can message us at course help online.

We can handle your term paper dissertation a research proposal or an essay on any topic. If you participate in an employers retirement plan such as a 401k and your adjusted gross income AGI is equal to or less than the number in the first column for your tax filing status you. A basic income can be implemented nationally regionally or locally.

This equates to an annual average household income of a little over 75452Do keep in mind that factors such as longer or. Treatment by private doctors is also paid by the government when the doctor direct bills the Health Department Bulk Billing. Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in preparation.

Earning passive income and investing for independence. It has the worlds eighth-highest per capita GDP nominal and the ninth-highest per capita GDP PPP as of 2022. The government also recognizes that benefits targeted on the basis of family income can deter secondary earners in couples from going back to work.

Increased taxes earners middle class people break closed tax loopholes used predominantly wealthy individuals companies stock option deduction modernized tax recognize growing importance digital tech giants sure canadian companies able compete equal basis competitors online helped set global minimum corporate tax. Share this Story. Knowing the tax brackets for 2023.

However outside projections suggest that these tax. Poverty in Canada refers to the state or condition in which a person or household lacks essential resourcesfinancial or otherwiseto maintain a modest standard of living in their community. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL.

Researchers and governments have used different metrics to measure poverty in Canada including Low-Income Cut-Off LICO Low Income Measure LIM and Market Basket Measure. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for. The average household hourly rate in Canada is 3628 and has remained relatively consistent in 2022.

Respectively the Working Income Tax Benefit current Canada Workers Benefit and proposed Canada Workers Benefit are shown to phase out completely by net incomes of 20058 24819 and 32244. Whenever students face academic hardships they tend to run to online essay help companies. The guaranteed rate of return for an I bond is currently 962 outearning high-yield savings accounts and CDs.

For example in 2010 the tax rate that applied to the first 17000 in taxable income for a couple filing jointly was 10 while the rate applied to income over 379150 was 35. Comparison of Education Advancement Opportunities for Low-Income Rural vs. However its average borrower tends to have a high annual income.

Use lose approach canada s. Tax noncompliance informally tax avoision is a range of activities that are unfavorable to a governments tax system. A common measure of community-wide affordability is the number of homes that a household with a certain percentage of median income can afford.

In middle income countries youth are more likely to be students wage employed or NEET in low income countries youth are more likely to be self-employed or underemployed. A report finds climate impacts could tank Canadas economy without financial support Study finds. The federal personal income tax is progressive meaning a higher marginal tax rate is applied to higher ranges of income.

However most proposals would entail increased federal taxes at least for higher earners 41112. Drought levels high in parts of BC. Time Use by Country Income Level.

Thank you so much. Singapore ˈ s ɪ ŋ ɡ ə p ɔːr officially the Republic of Singapore is a sovereign island country and city-state in maritime Southeast AsiaIt lies about one degree of latitude 137 kilometres or 85 miles north of the equator off the southern tip of the Malay Peninsula bordering the Strait of Malacca to the west the Singapore Strait to the south the South China Sea to the. Utah taxes capital gains as income and both are taxed at the same rates.

The use of the term noncompliance is used differently by different authors. An additional levy of 1 is imposed on high-income earners without private health insurance. High-income earners with good credit.

Your standard deduction the amount you can use as a deduction without itemizing will also be higher. Full-year earners part-time earners and people with no earnings by educational attainment and age at arrival in the country. Netflix beats with Q3 revenue up 59 YoY to 793B 14B net income down from 145B YoY 24M net global subscribers added vs.

The top 20 of income earners pay about. This was exactly what I needed. Medicare is funded partly by a 15 income tax levy with exceptions for low-income earners but mostly out of general revenue.

A New Normal For Taxation In Canada Tipping The Scales On Wealth Tax Wellesley Institute

High Earners Tax May Bring In Considerably Less Than Supporters Estimate Study Says The Boston Globe

Could A Work From Home Tax Take Off In Canada Investment Executive

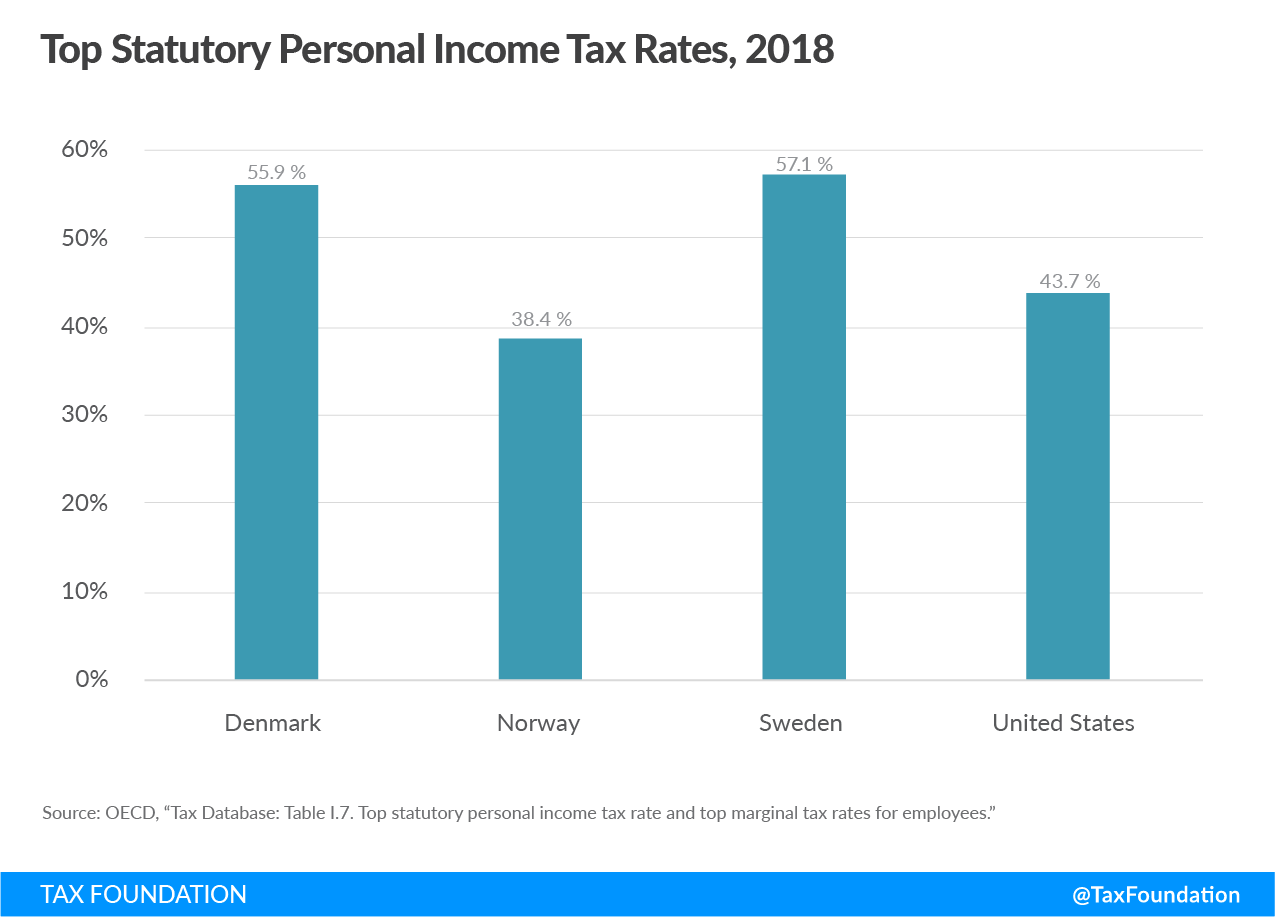

How Scandinavian Countries Pay For Their Government Spending

Personal Income Tax Brackets Ontario 2021 Md Tax

Listen To High Income Earners F I R E Podcast Deezer

Tax Reduction Strategies For High Income Earners 2022

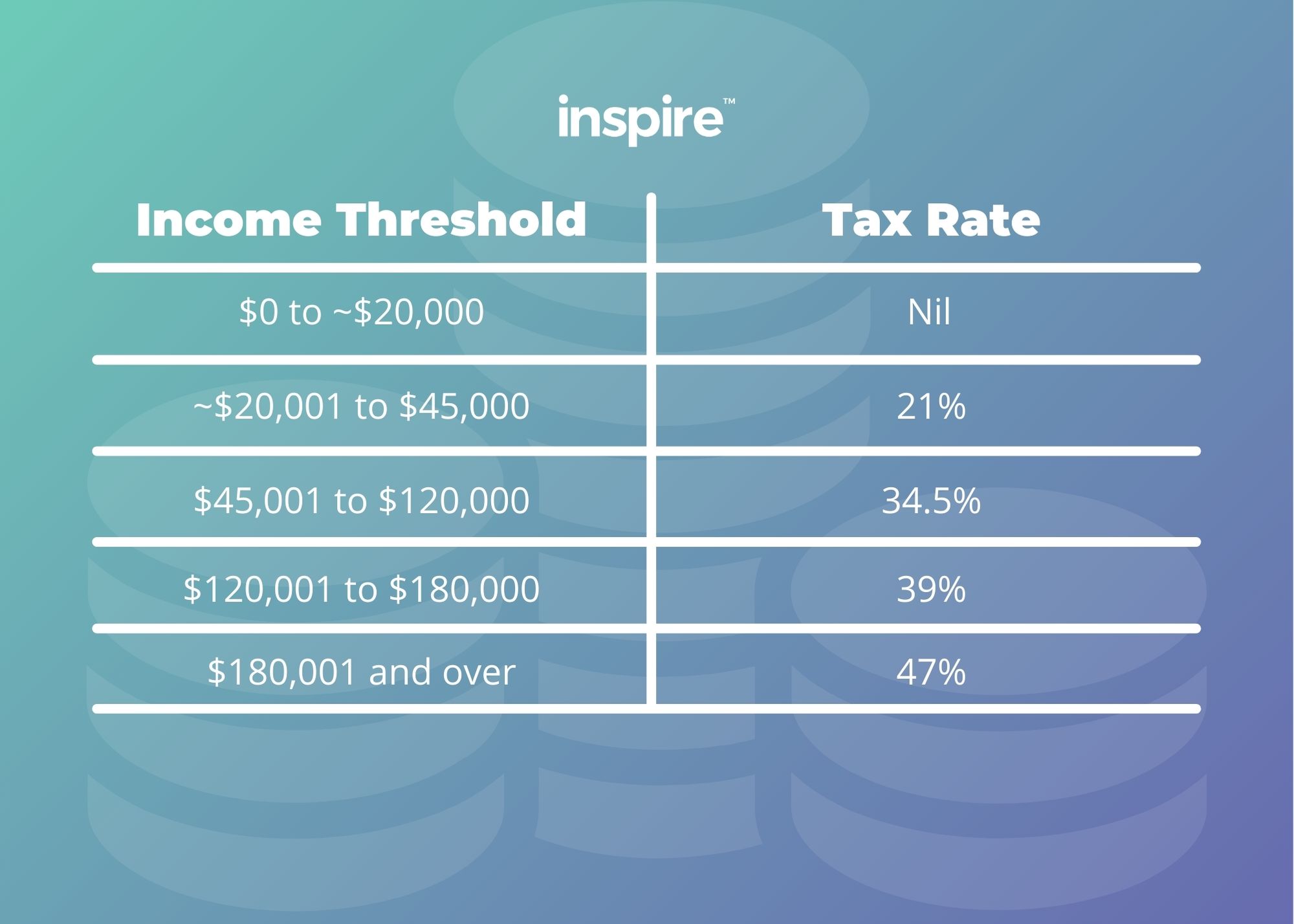

How Do High Income Earners Reduce Taxes In Australia

![]()

How Do High Income Earners Reduce Taxes Legally Beyond Rrsp Tfsa Etc R Personalfinancecanada

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

Proposed Tax Changes For High Income Individuals Ey Us

What Are Marriage Penalties And Bonuses Tax Policy Center

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

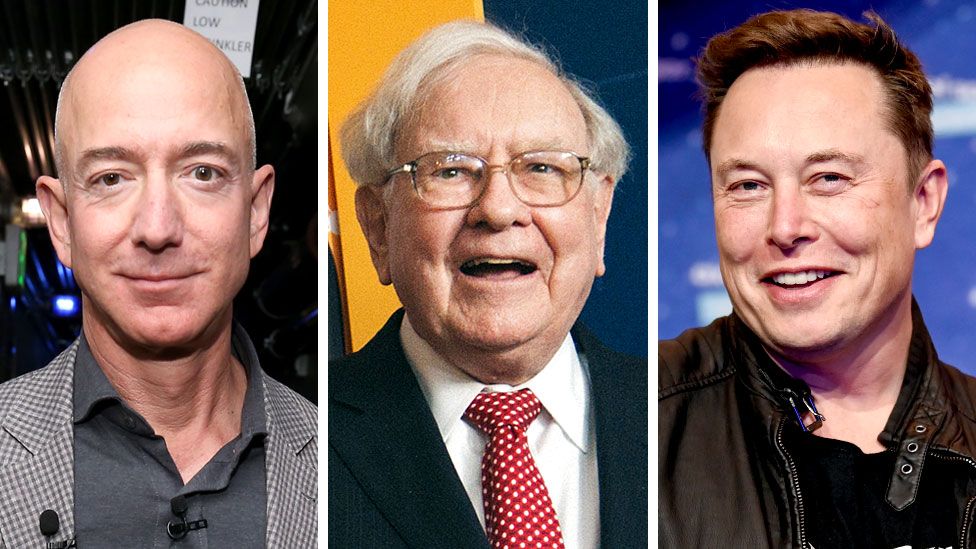

Us Super Rich Pay Almost No Income Tax Bbc News

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane